Collect Taxes easily on Deal of the Day Coupons

Your valuable feedback has inspired us to launch another fantastic Bookeo feature, and it’s going to make your life a whole lot easier.

As we’re sure you know, your business is responsible for collecting applicable taxes on any product or service sold via Deal of the Day websites, like GroupOn.

You told us you wanted to set up specific sales taxes that customers are required to pay online when redeeming their coupons, even after a 100% discount.

As usual, when you ask Bookeo, you shall receive: We’re delighted to announce that the feature you wanted is now live.

So go ahead. Try it out.

Set up taxes for your promotions

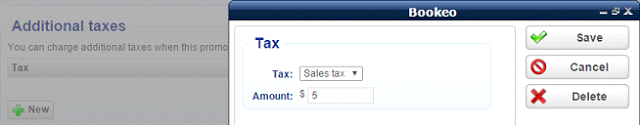

When you create a new promotion, just set up your specific tax amount per coupon.

Automatically, your fixed tax amount per coupon will be added by Bookeo to the booking price, even when the total post-discount booking price is $0.

Now, using Bookeo, you can charge those taxes right when your customers are redeeming their coupon codes online.

Here’s an example: You set a $5 sales tax per coupon on a GroupOn promotion. Next, your customer makes a booking using 1 coupon. Bookeo will automatically charge the set $5 sales tax. If your customer makes a booking using two coupons, Bookeo will charge a $10 sales tax ($5 per coupon), even after a 100% discount.

Easy accounting

As with all taxes, your Deal of the Day promotion taxes will automatically appear in your Bookeo financial reports. So doing your bookkeeping and accounting will be a breeze.

How do you know how much to set as your tax per coupon? It depends on where your business is located. Some states charge sales tax on the full amount of the purchase, as if there was no coupon. Other states only charge taxes on the amount of the coupon.

Your safest bet is to check and confirm your own state’s tax laws regarding Deal of the Day coupons.

Happy dealing!