New feature: Tax exempt customers

Do you have any customers (nonprofit charities, for example) who are exempt from sales taxes?

Then you’ll love our newest feature, which lets you easily set certain customers as tax exempt. It’s been one of our most requested innovations in the last few months, so we’re really excited to launch it this week.

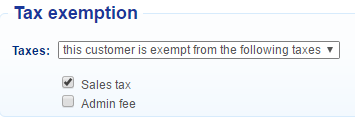

Now it’s easy to apply customized tax exemption status to any client. You can do this directly from your Bookeo calendar while you’re creating a booking, or do it right in the customer’s profile.

Multiple taxes or charges are no problem. For instance, if your business charges both sales tax and administration fees, you can specify the taxes from which the customer is exempt in one click.

Once you set a customer as exempt from specific taxes, Bookeo automatically knows not to add those taxes to that customer’s bookings. This exemption will apply whether you create the booking from your calendar or the customer makes the booking online.

Tax exemptions will also automatically be reflected in your reports. No value will show for specific taxes for tax-exempt customers, so you can effortlessly use your reports to see tax amounts collected from your customers.

If you want to know more about this feature, please see our tutorial here:

https://support.bookeo.com/hc/en-us/articles/360018200071

We believe this new feature will make running your business easier and smoother. Please be sure to let us know how it works for you.