How to Start a Business in Florida: A Step-by-Step Guide

Thinking of starting a business in Florida?

The Sunshine State is a unique blend of a relatively low cost of living and a diverse economy, making it a business-friendly state with a lot of opportunities. In fact, Florida is often ranked as one of the best states for starting a business by major publications like Forbes, making it a very popular destination for businesses of all sizes.

Yet, just because Florida is a great place to start a business and probably you’ve got a great business idea, it doesn’t mean starting and running your business will be smooth sailing. It may need a lot of work, but it can be very rewarding in the long run.

In this guide, we will share the steps you can adopt to increase the chances of success of starting a business in Florida. By the end of this guide, you’d have learned about the following:

- What business structure should you choose when registering your business

- How to register your business with the state of Florida

- How to get a business license

- Establishing a digital infrastructure and online presence for your business

- How to market your business and win more customers

And more.

Without further ado, let us begin right away.

Step-by-Step Guide to Starting a Business in Florida

Step 1: Deciding on a type of business to start

If you already have a business idea in mind, then you can skip this step.

However, if you are still looking for what kind of business to start in Florida, this section may provide some insights and inspiration.

In general, Florida has a very diverse economy with a relatively low cost of living. The cost of labor in Florida is also relatively lower than in many other states, making it ideal, especially for labor-intensive businesses.

Also, consider the fact that Florida is a popular tourist destination. Meaning, businesses that cater to tourists, such as hotels, restaurants, and tour operators, among others, tend to do well.

Florida also has a large retirement population, so businesses that cater to senior citizens, like retirement communities and medical providers, are likely to be successful.

Some of the most popular and successful business types in Florida include:

- Tourism-related: restaurants, hotels, attractions, travel agents, tour operators, etc.

- Manufacturing-related businesses: logistics companies, suppliers/vendors, marketing agencies, etc.

- Senior-focused services: assisted living facilities, medical providers for seniors, retirement communities, etc.

- Consumer-facing services: hair salons, fitness centers, spas.

- Home-based services: pet sitting, dog walking, house cleaning, and other businesses that can be operated from home.

- B2B businesses: legal firms, accounting firms, marketing firms, etc.

- Construction: as a growing state, there’s also a strong demand for construction services in Florida

Of course, this is not an exhaustive list, and there are other types of businesses that could be successful in Florida. Consider these tips on how to choose what types of business to start:

- Consider your skills and interest: it’s always better to start a business that you are passionate about or in an area that you’re good at. Starting a business in a niche that you have skills and experience in will increase the likelihood of being successful.

- Do your research: do your market research and competitive analysis so you understand the market you are entering. Also, research the regulatory environment in the area.

- Talk to other entrepreneurs: if possible, talk to other entrepreneurs in the area. They may be able to share their insights and advice on what types of business will be suitable for you.

- Government programs: there are a number of government programs in Florida designed to help you start a business. These programs may give you inspiration and resources on what types of businesses to start.

- Don’t be afraid of failure: every successful entrepreneur fails at some point. Don’t be stuck in the planning stage because you fear failing. Commit to learning from your mistakes, and keep moving.

Step 2: Choose a business structure

Once you’ve identified what type of business you are going to start, the next step is to choose a business structure.

In Florida, there are four main business structures to choose from:

- Sole proprietorship

- Partnership

- Limited liability company (LLC)

- Corporation

Each type of business structure has its own advantages and disadvantages, and below we’ll discuss them one by one.

- Sole proprietorship

A sole proprietorship is the simplest and the most common business structure type you can choose from. Simply put, a single (sole) owner is the business itself in this business structure.

This means this sole owner is also personally liable for all debts and obligations of the business.

The sole proprietorship is the easiest to set up and maintain, but you get very little to no liability protection.

- Partnership

A partnership is a business structure in which the business is owned by two or more partners, and each partner is personally liable for all of the business’s obligations and debts.

A little more complex to set up and maintain than the sole proprietorship, but you get more liability protection by sharing your obligation with a partner.

- Corporation

In the corporation business structure, the business is treated as a separate legal entity from its owner(s). This means the owners are not personally liable for the corporation’s debts and obligations.

Corporations are more complex to set up and maintain than sole proprietorships and partnerships, but they offer the best liability protection.

- Limited Liability Company (LLC)

An LLC is essentially a hybrid business structure where you’ll get the benefits of a sole proprietorship/partnership and a corporation: the owners are not personally liable for the debts and obligations, but the income and expenses of the LLC are passed through to the owners’ individual tax returns, which can translate into a significant tax advantage.

An LLC is also more flexible than a corporation but offers better liability protection than a sole proprietorship or a partnership.

Choosing the right business structure for your business is a very important decision that can affect you financially and legally on a long-term basis. It’s best to consult with an accountant or legal attorney before deciding on a structure based on your unique needs.

Step 3: Register your business

Once you’ve identified what type of structure your business is going to adopt, it’s time to register your business.

The steps we’ll discuss below are specific to the state of Florida and may vary if you are located in a different state. Before you can register your business, however, you should choose a business name (or brand.)

Choosing a business name

Your business name should be easy to pronounce and remember and should also be relevant to what your business is doing, as well as your products or services.

Here are some additional tips when choosing a business name:

- Make sure your business name is unique. In Florida, you can use the Florida Department of State’s Business Entity Name Search tool here. Your business name cannot be the same as another business’s name in Florida.

- Your business name should not be misleading or deceptive

If the business name of your choice is currently available, you can reserve it by filing a Name Reservation Request with the Florida Department of State, which is available on the Florida Department of State’s website.

The reservation period is 120 days, with a filing fee of $25.

Once you have chosen and reserved your business name, you can proceed to the next step: registering your business with the Florida state.

Registering your business

Registering your business with the state of Florida is essentially about filing some paperwork, including:

- Articles of incorporation: if you are looking to form a corporation, this is the document you’ll need to file with the state of Florida. Mainly states the name of the business, its purpose (product/service you sell) and its registered agent. The filing fee for Articles of Incorporation in Florida is $100.

- Articles of organization: similar to the above, but this document is filed with the Florida state to form an LLC instead of a full corporation. The filing fee for Articles of Organization is $50.

- Fictitious name statement: if you are going to register a business name that is different from your (as the owner) legal name, you’ll need to file this document. Typically required for businesses that use DBAs (Doing Business As) or trade names. The filing fee for this document is $50.

If you are going to register a sole proprietorship or partnership and not use a fictitious name (trade name), then you are not required to fill out any paperwork with the state.

Regardless, before filing any paperwork, make sure to read the given instructions carefully and make sure you understand them. Keep copies of all the paperwork you’ve filed with the state.

Step 4: Getting a business license and permits

Now that you’ve filed the paperwork and registered your business with the state of Florida, the next step is about getting a business license from your county or city government.

The actual requirements for these licenses may vary from county to county and city to city. So, it’s best to contact your local government or local trade association to find out the requirements.

In most cases, getting a business license is just a matter of contacting your local city/county government and filling out an application. You will need to provide basic information about your business (name, address, phone number, type of business), and you may also need to provide personal information about the owner (or owners) of the business.

Once you’ve submitted your application, you will need to pay the application fee. The actual fee can vary from city to city and county to county.

The business license is typically valid for one year, and you will need to renew annually. The process for renewing the business license is typically similar to the application process for obtaining a new license.

In addition to a business license, depending on the type of business you are going to open, you may need to get permits before you can start operating as a business in Florida:

- Food service businesses: restaurants, cafes, and businesses serving food and (non-alcoholic) beverages will typically need a food service permit from their local health department.

- Alcohol-serving businesses: such as bars, clubs, and restaurants, will typically need a liquor license from the city/county government.

- Businesses that operate in historic districts: Businesses that operate in historic districts may need a special permit from the local government.

- Businesses that operate in certain industries: such as healthcare, construction, beautician, and massage therapy, may need additional permits from their state or federal government.

Step 5: Open a business bank account

Once you’ve obtained your business license and any required permits, the next step is to open a business bank account that is separate from your personal account.

This will mainly help to keep your personal and business finances separate (and protect your personal assets in case of lawsuits), but there are also other potential benefits for your business:

- Help you track your business income and expenses accurately

- More convenience in making deposits and paying your bills

- Enabling your business to take out loans (and lines of credit)

- Better interest rates than personal banking account

- Qualify for business-specific programs and benefits

To open a business bank account, simply contact your local bank and open an account. You will typically need to provide them with your business information.

Step 6: Get an Employer Identification Number (EIN)

Note: if you are going to run your business on your own and won’t take employees, you can skip this step.

An EIN (Employer Identification Number) is a nine-digit number that is given to businesses in the US by the IRS for tax purposes. If you have employees (even just one of them), you will need an EIN to file your taxes.

You can apply for your EIN online via the IRS website, by mail (download, print, and send Form SS-4 from the IRS website), or by phone at 1-800-829-4933. You will need to provide the IRS with your business’s basic information and the owner (or owners)’s information, such as your name, address, and Social Security Number.

Step 7: Setting up a business phone system

Having a professional phone system can help your business look more professional and credible to customers and can also improve accessibility, customer service excellence, and efficiency.

There are many different types of business phone system solutions available in the market, with varying prices. Simply choose one that meets your business’s specific needs regarding:

- The number of users: if you only have a few employees at the moment, you may not need an overly complex business phone system. However, it’s best to choose a solution that is scalable so you can add more users easily and cost-effectively.

-

- Features: you may or may not need advanced features such as voicemail, call forwarding, and conference calling. The more advanced features you’ll get, the more expensive it will be.

- Budget: business phone system solutions can vary in price from under $100 to several thousand dollars. Choose a system that fits your needs and budget.

Once you’ve chosen and purchased a business phone system, make sure it’s properly set up and configured so it’s working as intended.

Step 8: Establish a digital infrastructure

In today’s digital age, it’s very important for any business to have a strong online presence.

It’s critical to establish a proper digital infrastructure, which may include having a professional website, email address, social media profiles, and other online solutions to help manage your business.

- Website: a professional-looking and functional website is important as your business’s digital storefront. Your website is where potential customers can learn about your business, your products/services, and how to contact you. Fortunately, it’s now much easier and affordable to build a professional website with platforms like WordPress, Wix, Squarespace, and others.

- Email: email is essential for any business, despite the newer technologies and marketing channels. Email marketing is still effective for staying in touch with prospects/customers, promoting your products/services, and retaining existing customers via your newsletters.

- Social media: with seemingly everyone now active on social media, it’s only obvious that having a strong social media presence is highly important. Also, consider investing in paid social media advertising and influencer marketing.

There are also many different online tools and solutions available to help you manage and operate your business, including:

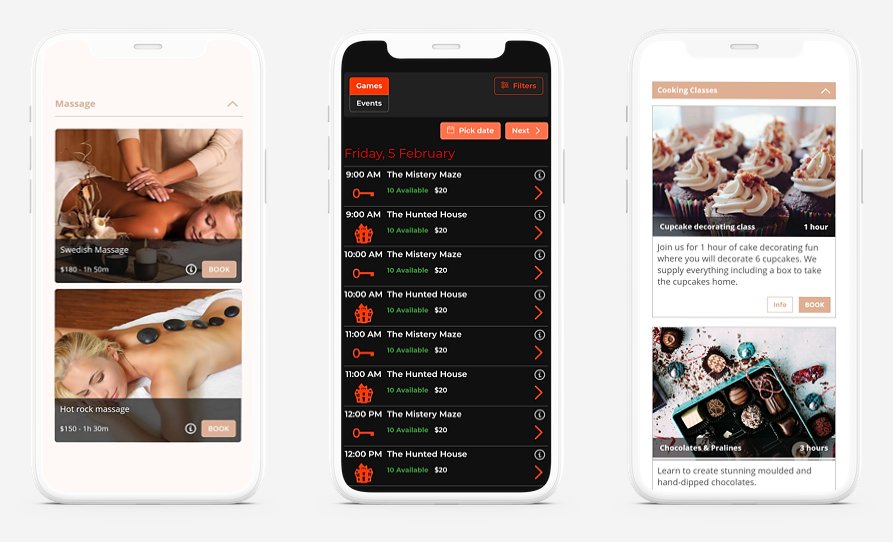

- Bookeo: Bookeo is an online appointment scheduling tool that can help you enable a 24/7 online booking function on your website. Especially if you are starting a service, axe throwing, charters or birthday party organizing business that relies on client appointments, having a reliable online booking software is simply a must.

- Quickbooks: proper accounting is a very important backbone of success for any business. Quickbooks is a popular and cost-effective accounting software that can help you easily keep track of your business’s finances, manage your inventory, and send professional invoices.

- Slack: Slack is a popular team communication and collaboration platform that can help your team stay in touch with each other and help you communicate and monitor your employees. A must-have tool if you are planning to have employees.

As a business owner in Florida, you have access to various resources that can assist you in building a digital infrastructure. The Florida Department of Economic Opportunity and the Florida Small Business Development Center offers a range of resources for you to take advantage of.

Step 9: Create a marketing plan

Now that you have most of the business’s foundations and infrastructure ready, it’s time to plan how you are going to market and promote your business to potential customers.

The Florida Department of Economic Opportunity has a number of resources available to help you market your business, including:

- A guide to marketing your business

- A directory of marketing resources

- A list of marketing events

The Florida Small Business Development Center also has a number of resources available.

Here are some best practices for creating a marketing plan for your business:

- Define your marketing goal: what do you want to achieve with your marketing efforts? Is it to increase brand awareness? Generate more leads? Drive more sales? All of them? Know your goals so you can develop the right tactics and strategies to achieve them.

- Know your target audience: who is your ideal target market? Know who you are trying to reach with your marketing efforts, and gather as much information as you can about them.

- Choose the right marketing channels: there is a wide variety of offline and online marketing channels available, but not all channels are effective for every business. Choose the right channels that are most likely to reach your target audience and help you achieve your goals.

- Establish a strong brand identity: this includes your brand logo, tagline, color scheme, and consistency in marketing materials.

- Develop a unique value proposition (UVP): establish what makes your business unique from your competitors. What value do you offer that your competitors don’t?

- Create effective marketing messages: your marketing messages should be clear, persuasive, and concise. Make sure your messaging is always consistent with your brand identity.

- Establish a system to track and measure your progress: it’s critical to keep track of the results of your marketing campaigns along the way so you can make the necessary adjustments.

Step 10: Get insurance

Insurance is not legally required for starting a business in Florida. However, it’s highly recommended to get insurance to protect yourself and your business from financial risks in the case of unforeseen events.

It’s worth noting that the Sunshine State is known for floods, hurricanes, and other natural disasters. If your business is not insured, you could be facing major financial losses or even bankruptcy when affected by these disasters.

Here are some of the most important types of insurance for businesses in Florida:

- General liability insurance: will protect your business from lawsuits in cases of property damage or injuries caused by your business.

- Workers’ compensation insurance: covers medical expenses and lost wages for employees who can’t work due to work-related injuries and illnesses.

- Commercial property insurance: covers damage to your business property, including your inventory and equipment.

- Commercial auto insurance: covers damage to your vehicles and other vehicles involved in an accident with yours. It may also cover medical expenses for injured parties.

- Cyber insurance: covers the cost of data breaches and other incidents related to cyber-attacks.

Step 11: Track your finances

Last but not least, it’s important to set up a system to keep track of your expenses and income.

Keeping track of your finances can help you make informed decisions about your business and fix any issues as soon as possible.

There are many ways you can use to track your finances, but the most popular ones include:

- Spreadsheet: the simplest and most affordable way. There are many different Excel or Google Sheets templates available online, or you can create your own.

- Accounting software: you can leverage solutions like QuickBooks or FreshBooks to help you keep track of your finances, create invoices, and generate automated reports.

- Hiring an in-house accountant: as your business grows, you may need to hire an accountant to help you keep track of your finances. This can also be a good option from the start if your business has a relatively complex business model.

Bottom Line

While starting a business in Florida can be challenging, it can serve as a great opportunity for you to achieve your personal and financial goals.

The important is to do your research homework and plan carefully before you dive deeper. Identify your purpose and goals, know your target audience, and establish a strong business plan while preparing the necessary infrastructure for your business.

In this article, we have discussed an overview of the steps involved in starting a successful business in Florida. By following these steps, you’ll have a solid foundation for building your business for success.

* The information contained in this article is being provided solely as general advice, and with the understanding that it is not intended to be interpreted as specific legal, financial or compliance advice.