Step-by-Step Guide to Building a Thriving Business in Georgia

The sun-drenched Georgia isn’t just thriving for pecans and peaches but also for diverse entrepreneurial ventures: a vibrant tourism sector with its natural wonders and tourism spots, a rapidly growing tech hub, vast lands ripe for innovative agriculture businesses and farmlands, and more.

Not to mention, the state of Georgia doesn’t just stand back – fledgling businesses can take advantage of government initiatives like tax breaks, grant programs, and mentorship opportunities,

Thus, whether you’re a seasoned business veteran or a striving entrepreneur, Georgia is definitely a welcoming environment for your business idea to take root and blossom.

Yet, just because Georgia is a lucrative location to start a business doesn’t mean you’ll automatically achieve success just by starting one. You’ll still need good planning, preparation, and informed decision-making along the way, and this is where this guide comes in.

In this guide, we’ll walk you through each step and equip you with the resources and knowledge to start a business in Georgia where we’ll cover:

- The foundational steps of starting your business, from conceptualization to writing a business plan

- Choosing the right business structure and registering your business

- Securing business insurance

- Funding options for your business

- Establishing a strong online presence

- Building a strong day-to-day business management and operation

So, ready to embark on your Georgia entrepreneurial journey? Let’s dive deeper into this guide.

Section 1: Foundational Steps for Your Georgia Business Success

1. Conceptualizing Your Business

Every journey begins with a single step, and for your business, it starts with a concept – an idea.

Don’t underestimate the importance of the conceptualizing stage, a good concept is a critical foundation for a successful and sustainable business. Below is a step-by-step guide on how to conceptualize your business:

Step 1: Brainstorming

Identifying your passion and skills

Ask yourself, what truly excites you? What skills and experiences can you turn into a business? How can you channel this expertise and experience into a business?

Think beyond your hobbies. On top of being passionate, you should be able to bring specific skills and talents to the table. Recognizing your strengths will allow you to choose a business idea that leverages your natural abilities, improving your chances for success.

Do proper brainstorming to unearth innovative concepts that resonate with your authentic self.

Market matchmaking

Explore the broader market and try to find gaps where your passion and skills intersect with market needs. Analyze industry trends: what needs are out there? What desires can your business fulfill, or what problems can it solve?

You might want to seek inspiration from the success stories of other businesses. Don’t be afraid to get creative, and remember that differentiation is an advantage.

Step 2: Market Research

Once you’ve identified a business concept, conduct market research to examine three key things:

- Industry trends: Stay up to date on trends shaping your chosen industry. Analyze emerging technologies, economic shifts influencing the market, and recent changes in consumer behaviors.

- Competitive analysis: Story your direct and indirect competitors – their strengths, weaknesses, unique strategies, and so on. Identify gaps where you can outshine these competitors.

- Target audience: Understand who your ideal customers are. Create detailed buyer personas to grasp your target audience’s behaviors, needs, preferences, expectations, and pain points.

Step 3: Choosing a Viable Business Concept

Based on insights from your brainstorming and market research, it’s time to select a viable business idea that has the potential for success.

List down your idea, and evaluate the feasibility of each idea. Consider factors like market demand, scalability, and whether you’ll be able to execute the business model effectively.

Some tips:

- Embrace research: Utilize online resources, attend industry events, and talk to potential customers (i.e., via surveys, focus groups, or even simple conversations) to gain valuable insights. This ensures that the chosen idea not only excites you but also addresses a genuine market need.

- Be realistic: Consider the resources, budget, and personal capacity required to launch, run, and sustain the business. Assess financial investments, time commitments, and any additional support needed.

- Value and goal alignment: Choose a business idea that brings you personal fulfillment and satisfaction.

- Profitability assessment: Can you generate enough revenue to sustain the business and achieve your financial objectives?

- Growth potential: Does the market offer room for your business to expand and evolve? Is scaling the business feasible?

By carefully considering your options and following these steps, you’ll choose a business concept that’s not just viable but also reflects your unique value and sets you on the path to success in Georgia.

2. Writing a Business Plan

Now that you’ve chosen a viable business idea, it’s time to translate your vision into a structured plan that guides your business toward success.

Don’t downplay the importance of writing your business plan. It’s not just a formality but an important roadmap and compass that can help steer your business through the dynamic landscape of Georgia’s business landscape.

A business plan is especially important if you’re planning to secure external funding (bank loans, investors, etc.,) but even if you’re going to fund your business on your own, a business plan can pave the way for a smooth launch and steady growth.

Basic Business Plan Structure

While there are variations depending on specific needs and audiences, a typical business plan follows this structure:

-

- Executive Summary: A concise overview of your entire plan, summarizing key aspects like mission, products/services, market, finances, and goals. Think of it as an elevator pitch, capturing the essence of your business in a compelling way.

- Company Overview: Delves deeper into your business, detailing its mission, history, and unique value proposition. Explain what you do, why you do it, and who you serve.

- Market Analysis: A thorough assessment of your target market, including size, demographics, trends, and your competitive landscape.Shows your understanding of the market your business operates in and identifies opportunities and challenges

- Management & Personnel: Introduces your leadership team, highlighting their skills, experience, and qualifications. Demonstrates your team’s ability to execute the plan and manage the business effectively.

- Marketing & Sales Strategy: Outlines your plan for reaching your target audience, promoting your products/services, and generating sales. Details your marketing channels, pricing strategies, and sales process.

- Operations & Logistics: Explains how your business will function day-to-day, including production, inventory management, customer service, and technology needs.Shows how your operations are efficient and well-organized.

- Financial Projections: Forecasts your financial performance for the next few years, including revenue, expenses, profits, and cash flow. Demonstrates the viability of your business and its potential for profitability.

- Appendix: Includes supporting documents like resumes, market research data, financial statements, or legal agreements. Provides additional details and resources for understanding your business plan.

Remember that this is just a general overview, and you can customize the specific structure depending on your business, target audience, and the business plan’s purpose. Tailor your plan to effectively communicate your business’s vision.

Some tips on how to write an effective business plan:

- Clarity and conciseness: Write in a clear and concise manner and avoid using technical jargon unless it’s absolutely necessary. Your goal is to make sure your target audience can understand your plan easily.

-

- Focus on the essentials: Avoid overwhelming your readers with unnecessary details, focus on highlighting the key information.

- Tailor your plan to your target audience: Will the business plan only for internal use? Or is it for investors or partners? Adjust the content accordingly and address any potential concerns/questions they might have by providing clear answers within the plan.

- Research and data: Use industry research, statistics, and market trends to support your assertions. When presenting data, make sure to do so in clear and visually appealing formats like charts and graphs.

- Demonstrate your path to profitability: In the financial projection section, clearly demonstrate how your business will generate sustainable income and achieve its financial goals. However, be realistic and don’t overestimate revenue (or underestimate expenses.) Base your projections on industry benchmarks and solid research.

- Visual appeal: Ensure professional presentation by making sure your plan is free of typos, well-formatted, and has a consistent style. Break up text with headings/subheadings, numbered lists, and bullet points. Consider using charts/tables/diagrams for data visualization.

- Building on Georgia’s strengths: Highlight how your business is going to be a part of Georgia’s vibrant entrepreneurial landscape:

- Specific regulations and licensing requirements: Familiarize yourself with local laws and permits your business may be required to get.

- Georgia’s unique advantages: Showcase how your business leverages the state’s tourism, agricultural, or tech industries in your plan (if applicable.)

- Stay adaptable: Be prepared to adjust your plan based on received feedback, as well as unforeseen circumstances. Update and revise your plan regularly to reflect changes in your business and market.

3. Choosing The Right Business Structure

You’ve nurtured your business idea into a working concept and crafted a roadmap with the business plan. Now, the next step is to choose the right business structure.

While this step might seem like a legalese formality, it’s actually an important foundation for your business’s longevity and success.

In this section, we’ll break down the different structures, their implications, and guide you toward the best fit for your venture:

Business Structure Options

Sole proprietorship: The simplest business structure in which the business owner and the business is treated as one legal entity.

-

- Advantages: The easiest to set up with minimal paperwork. The business owner has full control of the business.

-

- Disadvantages: Unlimited liability, so the owner’s personal assets are on the line when the business is in debt. May have difficulty raising capital, limited growth potential.

Limited Liability Company (LLC): A hybrid structure, owners have limited liability for business debts (their personal assets are protected), similar to full corporation, but there is also operational flexibility similar to a sole proprietorship.

-

- Advantages: Limited liability, pass-through taxation to avoid double taxation, management structure flexibility.

-

- Disadvantages: More complex setup than a sole proprietorship, potential annual fees.

S-Corporation: A specialized type of LLC with tax benefits. Taxed like a traditional corporation but with limitations of structure and ownership liability.

-

- Advantages: Potential tax benefits for owners, limited liability for business debts. Typically, it can attract investors more easily.

-

- Disadvantages: Stricter eligibility requirements, more complex filling processes, and intricate compliance requirements.

C-Corporation: A structure in which the owner is legally separated from the business. Has its own tax structure and governance.

-

- Advantages: Limited liability for debts, easier access to capital, perpetual existence independent of ownership changes.

-

- Disadvantages: Double taxation (owners are taxed with both corporate and personal taxes.) Complex setup, complex governance requirements, and higher compliance costs.

Considerations Specific to Georgia

Remember that when choosing your structure, you are also entering Georgia’s unique business landscape. Consider the following:

- Taxes: Georgia doesn’t have a personal income tax, making sole proprietorships and LLCs potentially attractive from a tax perspective.

- Regulations: LLCs offer a good balance between simplicity and liability protection, aligning well with Georgia’s business-friendly environment.

- Growth Potential: If you envision rapid growth or attracting investors, consider S-Corporations or C-Corporations for their ability to raise capital and offer stock options.

Choosing the right business structure is a crucial decision for your business, as it can affect operational/management flexibility and owner’s liability for debts. Considering consulting with an experienced professional, like a lawyer or accountant familiar with Georgia’s business regulations, is highly recommended.

Section 2: Making Your Georgia Business Official

Now that you’ve done with the preparations part, you are ready to make your Georgia business dream a reality.

In this section, we’ll discuss how to transform your business concept into a legally recognized entity in a step-by-step guide:

1. Claim Your Business Name

Your business name is your business’s identity, and more than just a moniker. Once you’ve chosen a business name, register it the the Georgia Secretary of State to ensure its legal standing and uniqueness:

- Check name availability: Check whether your desired business name is available before registering. You can head to the Georgia Secretary of State’s website and use the name availability search tool for this purpose.

- File the necessary paperwork: Submit the required paperwork to officially register your business name. Online filing options may be available.

- Consider trademarking: Not mandatory, but consider trademarking your business name, not only for additional legal protection, but also to leverage branding opportunities.

- Obtain an EIN (Employer Identification Number): An Employer Identification Number (EIN) from the IRS acts like your business’s social security number. It’s crucial for various purposes, including filing taxes, opening bank accounts, and hiring employees. You can obtain an EIN online (quick and free) through the IRS website.

- Registering for State and Local Taxes: Not the most exciting part, but tax compliance is an important foundation for operating a legitimate business. Register for state and local taxes with the Georgia Department of Revenue. The specific taxes you’ll need to register for depend on your business structure and activities. Utilize the department’s resources and online tools to navigate this process smoothly.

- Acquiring necessary licenses and permits: Certain professions and industries require specific licenses and permits to operate legally. Investigate the specific permits and licenses required for your industry. The Georgia Department of Economic Development’s website provides a helpful license lookup tool to guide you. Remember, local governments might also have additional licensing requirements, so check with your city or county clerk’s office.

- Display certifications properly: Submit applications for necessary licenses and permits promptly. Once obtained, display the permits and licenses conspicuously at your business, showcasing your commitment to compliance. Maintain copies of all registration documents, permits, and licenses for future reference.

By following these steps, you can confidently transform your Georgia business idea into a legally recognized entity. In the next section, we will explore the different options available for funding your business.

2. Funding Options for Your Thriving Business

You’ve officially registered your business, and now it’s time to fuel your business with the essential ingredient: funding.

There are a few options for funding your vision into reality:

- Personal savings: Starting with your own money is a common starting point for many entrepreneurs. It offers full control and complete ownership, as well as avoids debt. However, it also means limited availability and personal risk.

- Loans: Immediate access to capital, but will also cause debt obligation. There are several loan options to consider:

-

-

- Bank loans: Traditional lenders offer loans for established businesses with strong credit history and solid business plans. Research interest rates, terms, and eligibility requirements carefully.

- SBA loans: The Small Business Administration (SBA) guarantees a portion of loans from participating lenders, making them more accessible for startups. Explore options like the 7(a) loan program for various business needs.

- Alternative lenders: Online lenders and peer-to-peer platforms offer alternative financing options, often with faster approval processes but potentially higher interest rates. Weigh the pros and cons carefully.

-

- Grants and Investments:

-

- Government grants: While federal grants for starting businesses are rare, Georgia offers various programs like the Innovation Fund or Rural Business Development Grants. Research and apply for relevant opportunities.

- Angel investors: High-net-worth individuals invest in promising startups, often in exchange for equity or ownership stake. Connect with Georgia-based angel investor networks to showcase your potential.

- Crowdfunding: Platforms like Kickstarter or Indiegogo enable you to raise funds directly from a large pool of individual contributors. Craft a compelling campaign and leverage online communities effectively.

Georgia’s Funding Resources

Georgia has a supportive ecosystem for small businesses and startups, with resources to support funding:

-

- Small Business Development Centers (SBDCs): These free or low-cost counseling centers offer guidance on funding options, business plans, and navigating the entrepreneurial landscape. Some SBDCs in Georgia also offer access to capital and experts to refine your business plan.

- Georgia Department of Economic Development: Explore their resource guide and grant programs specifically designed to support Georgia businesses.

- Angel investor networks: Connect with active angel investor networks like Georgia Investment Network to pitch your idea and potentially secure funding.

- Incubators and Accelerators: There are Georgia-based accelerators and incubators that provide access not only to funding, but also mentorship and networking opportunities.

Securing External Funding: Tips and Strategies

If you are planning to secure external funding, the key is demonstrating your business’s viability and ability to repay borrowed funds. Consider:

- Strong financial statements in your business plan

Above, we’ve covered the importance of crafting a business plan. Make sure it properly highlights your business’s unique value proposition and competitive advantage, and include accurate financial statements (income statements, cash flow projections, balance sheets.)

Clearly communicate how funding will be used and the expected ROI.

- Maintain personal and business creditworthiness

Maintain a strong business and personal credit profile. Address any outstanding debts or credit issues to enhance your creditworthiness.

- Craft a compelling investor pitch

Take the time to develop a compelling investor pitch that effectively communicates your business concept and potential. Explain the benefits of investing in your business, and try to personalize the pitch to resonate with the values and objectives of the individual investor.

- Maintain financial transparency

Transparency is key to securing investors. Clearly communicate how the funds will be used, and its impact on business growth. Once you’ve secured investors, make sure to keep them informed about financial performance to establish trust.

3. Essential Insurance for Your Business

Not only does the state of Georgia require you to safeguard your business, employees, and customers with mandatory insurance, there are also various insurance options to ensure that your business is adequately protected against unforeseen risks.

Mandatory Coverage

Georgia mandates the following types of insurance:

- Workers’ compensation: If your business employs even a single employee, you are legally required to have workers’ compensation insurance. This type of insurance will cover lost wages and medical expenses for when your employee experiences any work-related injuries or illnesses.

- Commercial auto insurance: If you use vehicles for business purposes, you are legally required to have commercial auto insurance to cover accidents and legal liabilities. Minimum coverage. Minimum coverage requirements vary depending on vehicle type and usage.

However, different industries have unique risks, and may be mandated specialized insurance coverage. Larger/more complex businesses, or those with higher risk activities may also require more comprehensive coverage.

Other Recommended Insurance Types

Beyond the mandatory above, consider these additional insurance options to protect your business from various risks:

- General Liability Insurance: Protects against claims of property damage, bodily injury, or personal injury arising from your business activities.

- Business Property Insurance: Covers damage or loss to your business property, including buildings, equipment, and inventory, due to fire, theft, or other covered events.

- Cybersecurity Insurance: Covers costs associated with data breaches, cyberattacks, and related legal or financial losses.

- Errors & Omissions Insurance (E&O): Protects against professional negligence claims in certain industries like consulting or financial services.

Section 3: Building a Strong Online Presence

For modern businesses in today’s digital age, maintaining a strong online presence is simply essential. Let’s explore how to craft an online presence that builds trust, attracts customers, and fuels your entrepreneurial journey:

1. The Cornerstone: A Professional Website

Today, your website is no longer just a virtual storefront, but is often the first impression, the first point of contact for potential customers. A well-designed and professional website is a reflection of your brand’s credibility and professionalism.

Your website should be:

-

- Professional and informative: Make sure your website is well-designed and user-friendly. The website should clearly showcase your products/services, mission, and contact information.

- Mobile-optimization: Many citizens of Georgia are now (exclusively) using their mobile devices to browse the internet. Make sure your website is mobile-optimized with a responsive design.

- Optimized for local SEO: Leverage Google Business for improved local search presence. Incorporate local keywords and meta tags to enhance your website’s visibility in Georgia’s local search results. Try to get more reviews on Google Maps/Google Business, as well as other relevant sites.

Fortunately, with platforms like Wix, SquareSpace, or even the handy WordPress, building a professional website has never been easier and affordable.

2. Embrace the Power of Online Booking

If your business relies on client appointments (i.e., yoga classes, dental offices, financial advisors, consultants, etc., ensure convenience by enabling online 24/7 appointment booking on your website and social media.

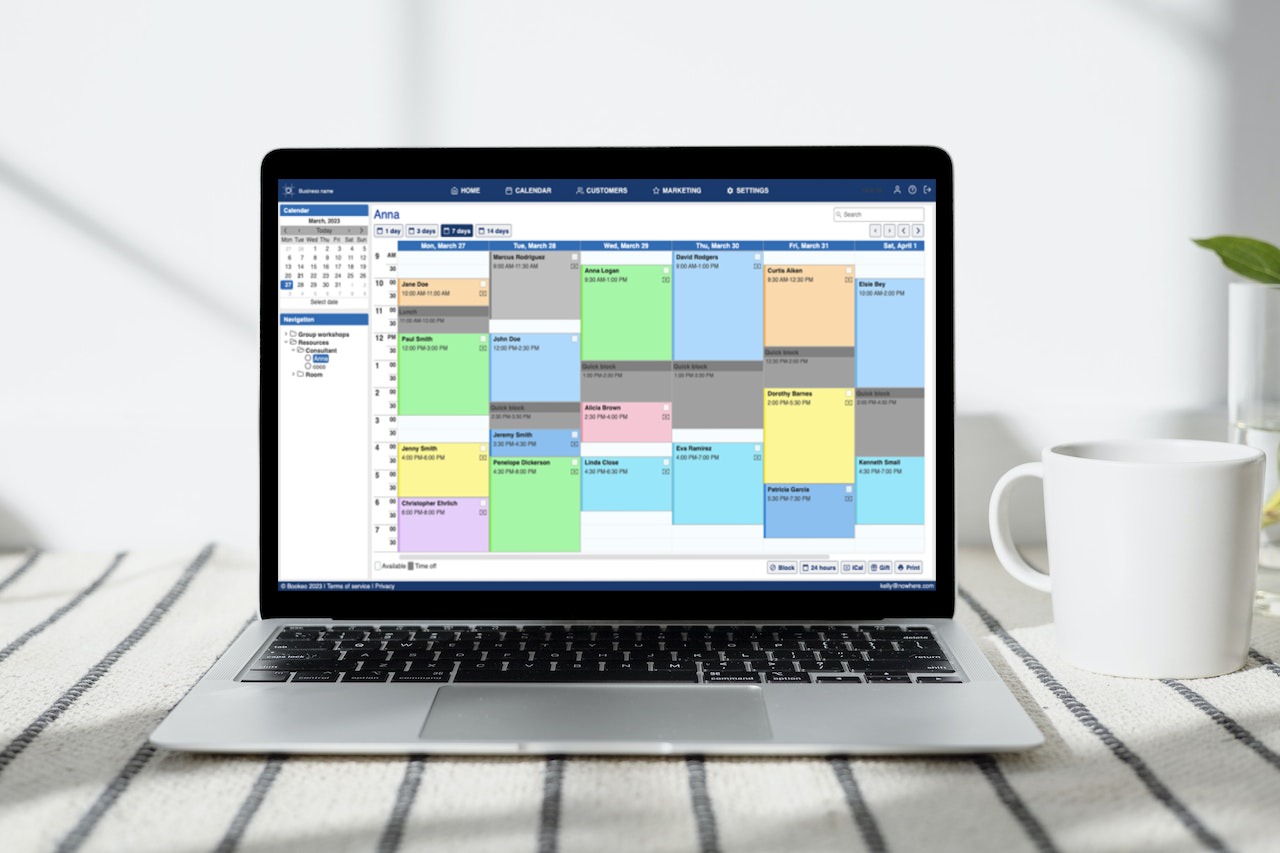

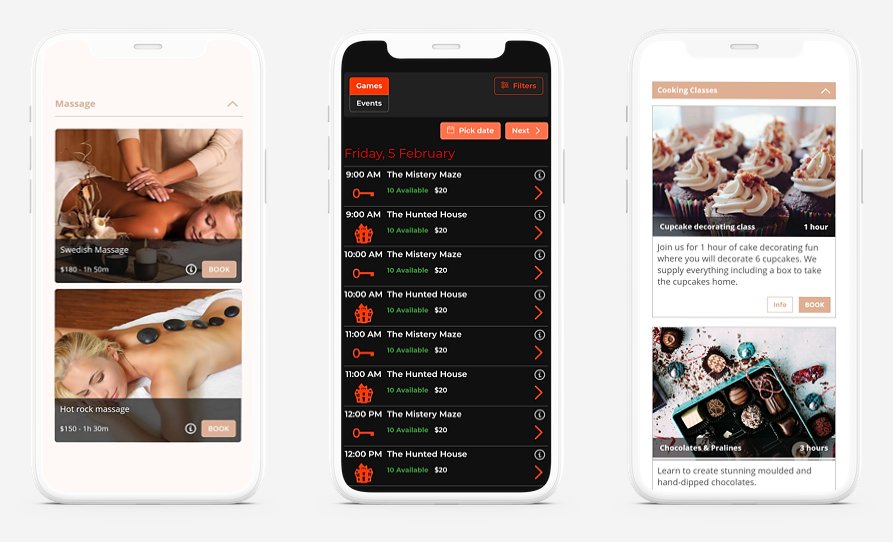

With online booking software like Bookeo, you can easily integrate an efficient appointment and reservation management for your axe throwing, boat reservation, training and course or any other type of business for a smoother and more efficient experience for both your clients and your team.

With Bookeo, you can allow customers to schedule appointments 24/7 at their convenience, but the benefits go beyond just bookings, and you can get features like:

- Automatic reminders: Send automated SMS or email reminders to reduce no-shows/missed appointments and boost customer satisfaction

- Calendar synchronization: Automatically sync new appointments with your chosen calendar app (iCal, Google Calendar, etc.), reduce double bookings, and ensure everyone is on the same page.

- Secure payment processing: Provide a seamless and secure payment experience for your customers, streamlining your cash flow and ensuring convenience for your customers.

Having a reliable online booking function on your website will allow you to focus on what you do best – growing the business instead of managing bookings manually. You will be able to embed Bookeo on your website, as it offers a booking app for Wix, scheduling plugin for WordPress, booking calendars that work with GoDaddy website, booking system for Weebly, booking system in Webflow and scheduling app for Shopify. Offering 24/7 booking options will also allow you to capture more bookings and streamline your payment process, helping your business grow.

3. Leveraging Social Media

In this social media age, it’s quite obvious that you should have a strong social media presence.

Social media isn’t just for sharing nice photos and videos, rather it’s a platform where you can connect with your target audience in Georgia. Here are a few tips:

- Choose the right platforms: Build a strong social media presence on platforms like Instagram, Facebook, X (formerly Twitter), LinkedIn, and others, depending on your industry. The idea is to choose platforms where your target audience is active.

- Build organic presence: Consistently share relevant content, including showcasing your work, promotions, behind-the-scenes glimpses, customer testimonials/success stories, and participate in relevant online communities.

- Invest in paid social media ads: Run targeted ads offered by these social media platforms to support your organic efforts and increase your business’s visibility. Leverage geo-targeting options to reach potential customers in specific locations within Georgia.

- Join Georgia-specific groups: Join local Georgia-specific groups and communities on platforms like Facebook and LinkedIn. Engage with potential customers, share insights about your business, and participate in discussions.

- Engaging Prospects and Customers: Actively participate in conversations mentioning your brand (or product/service), respond to comments, and answer questions.

4. Track and Analyze

Building a strong online presence isn’t just about creating content, purchasing digital ads, and hoping for the best. Tracking and analyzing your online performance is crucial not only for achieving your goals but also for a better understanding of your audience.

First, define your metrics. What aspects of your online presence matter most? Set clear KPIs (key performance indicators) such as:

- Website traffic: Track overall traffic, unique visitors, and sources of traffic to understand where your audience comes from.

- Lead generation: Monitor inquiries, form submissions, and appointment bookings to gauge your lead generation efforts.

- Engagement: Analyze likes, shares, comments, and website bounce rates to measure audience engagement.

- Conversion rates: Track how many website visitors convert into paying customers or take desired actions like signing up for a newsletter.

Then, choose the right tools to help you keep track of these KPIs. Popular choices include:

- Website analytics: Google Analytics provides insights into website traffic, user behavior, and content performance.

- Social media analytics: Built-in analytics dashboards on platforms like Facebook, Instagram, and LinkedIn offer audience demographics, engagement metrics, and campaign performance data.

- SEO analytics tools: Tools like SEMrush or Ahrefs help you track your website’s search engine ranking and identify keyword optimization opportunities.

- Email marketing analytics: Platforms like Mailchimp or Constant Contact provide data on email open rates, click-through rates, and campaign effectiveness.

When keeping track of data, remember that data is valuable, but context is key. Don’t just collect data, but analyze it so you can interpret it within the context of your industry benchmarks and overall goals. Schedule regular reviews to adapt your online strategy based on identified trends and shifts in audience behavior.

Section 4: Ensuring Smooth Day-to-Day Operations

Now comes the next crucial part: ensuring smooth day-to-day operations. In this section, we will equip you with the tools and strategies to navigate the operational and management journey effectively and efficiently.

1. Establishing Operational Procedures

Efficient procedures and systems are the backbone of smooth day-to-day operations. Whether it’s customer service, accounting, sales, or marketing, having clear, efficient, and optimized procedures is key.

- Implementing efficient procedures: Develop streamlined processes for key areas like:

- Customer service: Establish protocols for ensuring exceptional customer experiences, especially regarding handling complaints and inquiries.

- Marketing and sales: Implement a marketing and sales plan that attracts customers and converts leads into loyal clients. Make sure that your procedures resonate with Georgia’s diverse audience.

- Accounting and finance: Maintain accurate financial records, manage cash flow effectively, and comply with relevant tax regulations.

- Ensuring compliance: Adhere to state and federal regulations, including:

-

- Business licenses and permits: Ensure you have the necessary licenses specific to your industry and location.

- Tax regulations: Comply with state and federal tax requirements, including filing deadlines and payments.

- Employment laws: Understand minimum wage, overtime, and other labor laws to protect your employees and avoid legal pitfalls.

2. Building a Strong Team

In Georgia’s competitive business landscape and job market, assembling a strong team is a strategic necessity. Here are a few tips on how to recruit top talents, foster a positive work environment, and retain your talents:

- Highlight your company culture: Showcase your unique values and clearly communicate your mission so you can attract talents who align with your vision.

- Utilize local resources: Utilize local job platforms and networks, and connect with Georgia’s universities and job boards to find qualified candidates.

- Create a collaborative culture: Create a work culture that values collaboration and employee well-being. Encourage open communication and active feedback.

- Invest in training and development: Provide opportunities for professional growth so you can empower your team with the skills and knowledge they need to excel.

- Work-life balance: Promote healthy boundaries between professional and personal lives to prevent burnout.

- Retaining talent: Implement retention strategies such as competitive salaries/benefits and flexible work arrangements.

- Actively listen: Regularly solicit feedback and address employees’ concerns to maintain a positive and motivated team.

By implementing efficient operational procedures, ensuring compliance, and building a strong team, you can help establish smoother and more efficient operations for your Georgia business.

Conclusion

Congratulations on the launch of your business! You are now ready to take on the Georgia business landscape.

Launching and running a business can be challenging, but it’s important to remember that entrepreneurship is a journey of perseverance, creativity, and continuous learning. Every challenge is an opportunity for growth, and you possess the necessary skills, experience, and knowledge to guide you toward success.

If you’re ready to embark on your entrepreneurial journey, visit the Bookeo website today. Discover how it can become your essential partner in your business endeavor.